Capital Markets Days (CMDs) are pivotal for investor relations, and our proprietary analysis provides compelling evidence of their effectiveness. We show that CMDs can significantly boost trading volumes, generating a substantial impact on market activity.

Capital Markets Days, or CMDs, are the flagship events of any Investor Relations (IR) department, showcasing a company and charting a course for the years ahead. However, arranging a CMD consumes considerable resource—involving not just the IR team and the board, but everyone down to the office intern. Preparing the strategic message, arranging factory tours, live webcasts, and securing the perfect venue. It’s a logistical nightmare.

When we asked ourselves the question of whether CMDs actually pay off, we found little beyond the glaringly obvious “investors always appreciate an inside look” and “it’s an opportunity to make your company shine”. Instead we decided to look some at hard data, examining all CMDs and investor days across mid- and small-cap companies in The Netherlands over the past six years. In order to assess the actual impact of these events, we argue trading volume is the most relevant common metric as this best captures investor interest generated by a CMD.

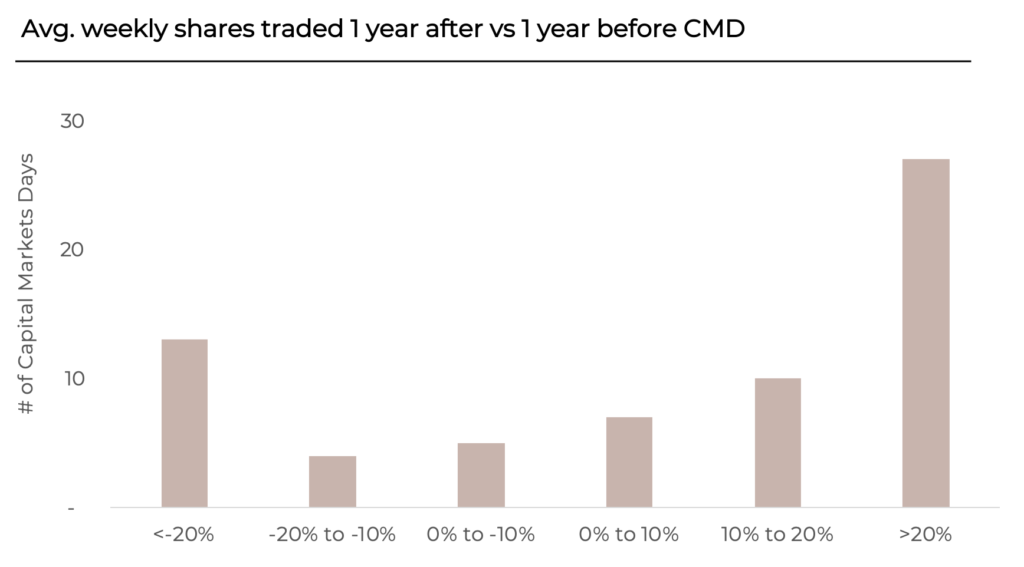

Testing the data over 1 year pre- and post-CMD we found that

- two-thirds of companies saw an increase in shares traded, and one-third saw a neutral to negative effect.

- the median increase in the number of shares traded was 12%. The average increase was a whopping 22%, but that was impacted by several positive outliers.

- of the companies that did see an increase, most saw a significant increase of more than 20% in shares traded.

- while the boost in shares traded was only limited and statistically insignificant in the short-term, specifically within the six months following the event, the positive effects became statistically significant between one to one and a half years later. This suggests that CMDs may wield their true influence over the medium term, shaping investor behavior gradually rather than immediately.

We also tested the statistical significance of the positive effect, and although we’d love to spend a whole blog post on the two-tailed Wilcoxon Signed-Rank Test using Z-scores for the 95th percentile, I hope you trust us when we say that the positive effect was statistically significant.

In conclusion, if you’re debating whether to host a CMD, the evidence suggests it’s a worthy investment. And if you’re looking to make your next CMD a success, that’s where we at Clearhart can help. Let us help you craft an event that informs and transforms your company’s narrative.