One of the questions we keep being asked is whether a comprehensive IR strategy truly impacts share price performance. After all, many companies argue that if we run our business well, the share price will take care of itself. Like everything in life, the answer is more nuanced than that, and as the old saying goes, the proof of the pudding is in the eating.

While good business performance and results can certainly drive share price growth, this is only part of the story. But unless you are Apple and the public is scrutinising your every press release, not everyone is going to know about you or be prompted to go and spontaneously look you up. By taking a laissez-faire approach, you’re likely leaving potential valuation upside on the table. Where are your marginal buyers if there is no strategy by which to target and develop new shareholders and bring the message to fresh ears? Without naming names, there are concrete examples of companies who managed to achieve better multiples than their peers simply didn’t even employ IR officer.

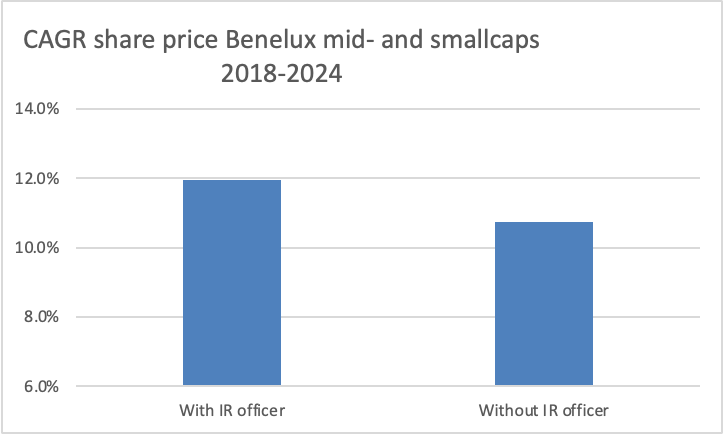

So what is the performance gap between having an IR function and not having one? While such analysis has its challenges, we attempted to measure this by comparing a set of mid- and smallcap universe, divided into groups with and without IR. Looking for longer-term trends, we analyzed six years of share price performance history. From our data set of companies exactly half had an IR officer. Over 2018-2024, we found the median company with an IR officer outperformed those without by 120 basis points per annum (11.9% vs. 10.7% share price growth CAGR). While this may seem modest, it compounds significantly: over six years, the share price of the median company with IR officer grew by 97% compared to 84% for those without.

It is also worth emphasising that lot of the factors that go to make up a comprehensive IR strategy are not quantifiable in hard data, but rather lie in understanding what investors are looking for, what the markets concerns are and thinking strategically and creatively around this to come up with a defined and specific plan. For instance, with the rise of Thematic ETFs, companies need to actively highlight their exposure to underlying thematic trends in order to be considered for inclusion. Should a hearing aid company for example actively position itself as offering exposure to aging population dynamics? If not, it is missing a trick. At Clearhart, with our combined 60 years of experience in listed markets and IR we can help you to position yourself and tell your story effectively to targeted investors, so you are not leaving elusive valuation multiple points on the table.