Last week, we talked about the potential changes to MiFID II rules that have led to significantly reduced sell-side coverage by brokers and independent research firms since its 2018 implementation. Sell-side coverage is vital for corporates as it stimulates investor interest and engagement and, at least in theory, a better chance of achieving fair value for the stock.

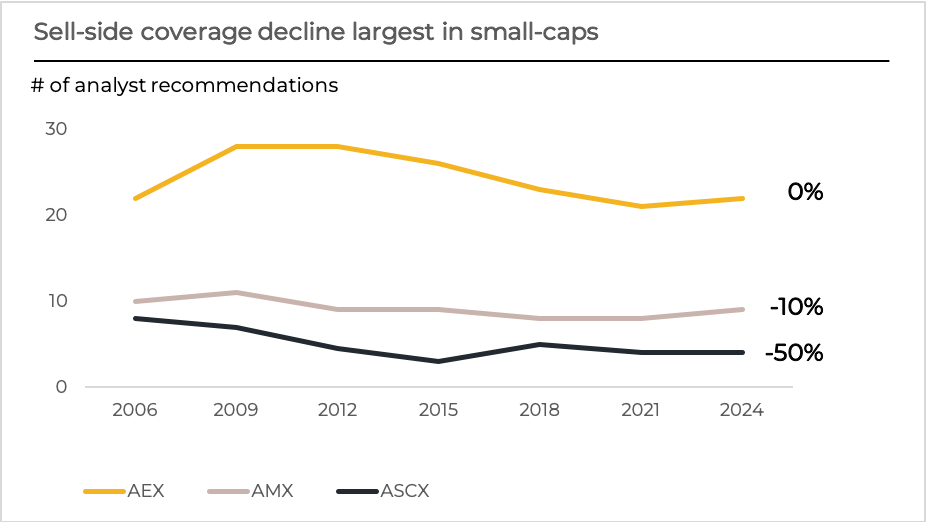

We decided to dig a little deeper into the data and see if the decline in coverage can be quantified with reference to the Dutch stock market. We analysed data from the AEX (large cap), AMX (mid cap), and ASCX (small cap) index constituents and the number of analysts covering them at 3 year intervals since 2006 yields some pretty damning conclusions as you can see from the chart below:

Peak coverage was in 2009. Not surprisingly, the financial crisis negatively impacted coverage, but initially only in mid- and small caps.

- AEX companies, on average, continue to have 2-3 times more analyst coverage than mid- and small-caps

- AMX company coverage declined by approximately 10% since 2006. The hopeful news is that there has been a very slight uptick since 2021, which can also be seen for the AEX names

- ASCX company coverage has taken the biggest hits by far, with a whopping decline of 50% since 2006. Half of the analysts covering these names have disappeared, and the median ASCX company only has 4 remaining analysts

For every listed company, maintaining a consistent and appealing equity story is crucial, and we highlighted in last weeks post just how significant the impact of this reduced coverage has been on valuations of mid and small cap names. In a landscape where fewer brokers champion smaller listed companies, finding a strategy and an experienced professional partner to help bridge the gap is vital. At Clearhart, we bring over 60 years of combined expertise in equity markets and investor relations to help you craft a narrative that resonates and connects with the right investors, combined with the skills and knowledge to make sure your message is seen and heard consistently. Let us help you increase your visibility to the market. Contact us today to learn how we can elevate your equity story together.