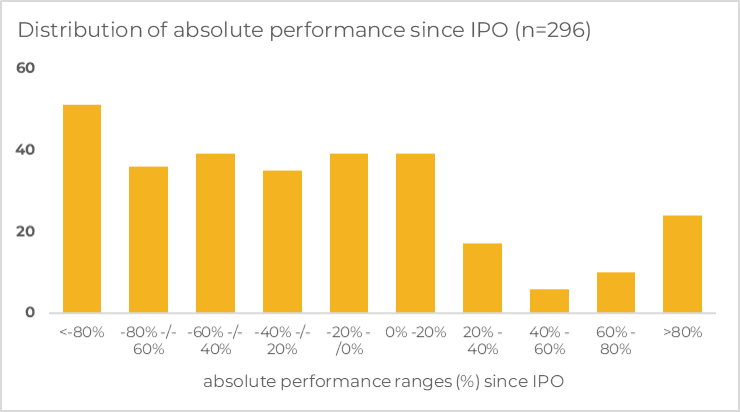

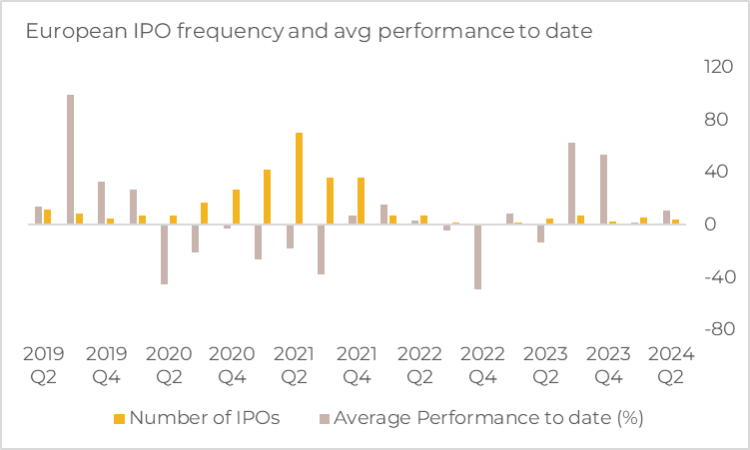

Here at Clearhart we know that IR strategy in and around IPO is vitally important to the future performance of your share price. IPOs are a defining event in the lifecycle of a company, often seen as a stamp of approval, and the crowning achievement of a lot of hard work. However, insufficient attention is often given to what comes after the IPO once your corporate advisors have left you to take your first steps in the harsh light of public markets. Getting your IR strategy and communication with the market right from the start is crucial and our analysis reveals how profound the consequences of a misstep can be. An analysis of the European IPO market over the last 5 years doesn’t reveal a pretty picture. Of the 296 European Initial Offerings over 2019-2024 with a deal size of more than €100M, 2/3rd now trade below their issue price. On a relative basis, the news is that a depressing 81% of IPOs during this period failed to beat the MSCI Europe index.

Looking at distribution of post-IPO performance, what’s most striking is the number of these which are arguably failed deals. With only a handful showing extraordinary positive performance post launch, buying IPOs indiscriminately is a failed investment strategy almost by definition. In addition, for the 2020 and 2021 vintages, returns have been disappointing, which has undoubtedly contributed to depressed activity since mid 2022.

We know from experience that while the groundwork and guidance in terms of targets is laid during the IPO process, continuity and consistency of communication is crucial. Unless you have been exposed to markets and have experience of multiple transactions it is not always obvious what those pitfalls are and how they can be easily avoided.

With close to 60 years of combined experience in hundreds of IPOs, as well as direct investor relations experience, we know the factors that are crucial to your success in the harsh spotlight of listed markets. Contact us to find out how we can support you so that you can take your first steps in public markets with confidence.